Peanut Chikki Market Trends in India: Opportunities for New F&B Brands

Introduction

Once seen as a humble winter sweet, the peanut chikki market is quietly emerging as a powerful player in India’s ₹700+ crore traditional snacking industry. Driven by the country’s shift toward clean-label, high-protein, and affordable indulgences, peanut chikki is evolving from a local mithai-counter product into a national FMCG opportunity.

For F&B entrepreneurs, this transformation presents a rare window: a product category rooted in Indian tradition but now poised for modernization – through packaging innovation, flavor diversification, and brand storytelling.

This blog explores the key trends shaping the peanut chikki market in India, what consumers are demanding, and where new food brands can innovate and grow.

An article that might interest you: How to Ensure Quality & Shelf Life in Peanut Chikki Manufacturing

Why Peanut Chikki Is More Than a Festival Snack

Traditionally sold during Makar Sankranti and winters, peanut chikki was often limited to seasonal consumption.

But today, urban consumers are buying it year-round – as an energy bar, post-workout snack, or travel-friendly sweet.

Key reasons for category expansion:

- Health perception shift: Natural ingredients like peanuts and jaggery align with clean-label trends.

- Affordability: Average price per unit remains ₹10–₹25, making it accessible across income segments.

- Pan-India appeal: Regional chikki variants (Maharashtra, Gujarat, Tamil Nadu) are now being standardized for national retail.

- Export potential: Indian diaspora demand for jaggery-based snacks is increasing, especially in the UAE, UK, and Canada.

According to NielsenIQ 2025 estimates, traditional Indian sweet snacks like chikki and til laddoo are projected to grow at a 12–15% CAGR over the next three years, making this one of the most undervalued yet scalable snack categories in the country.

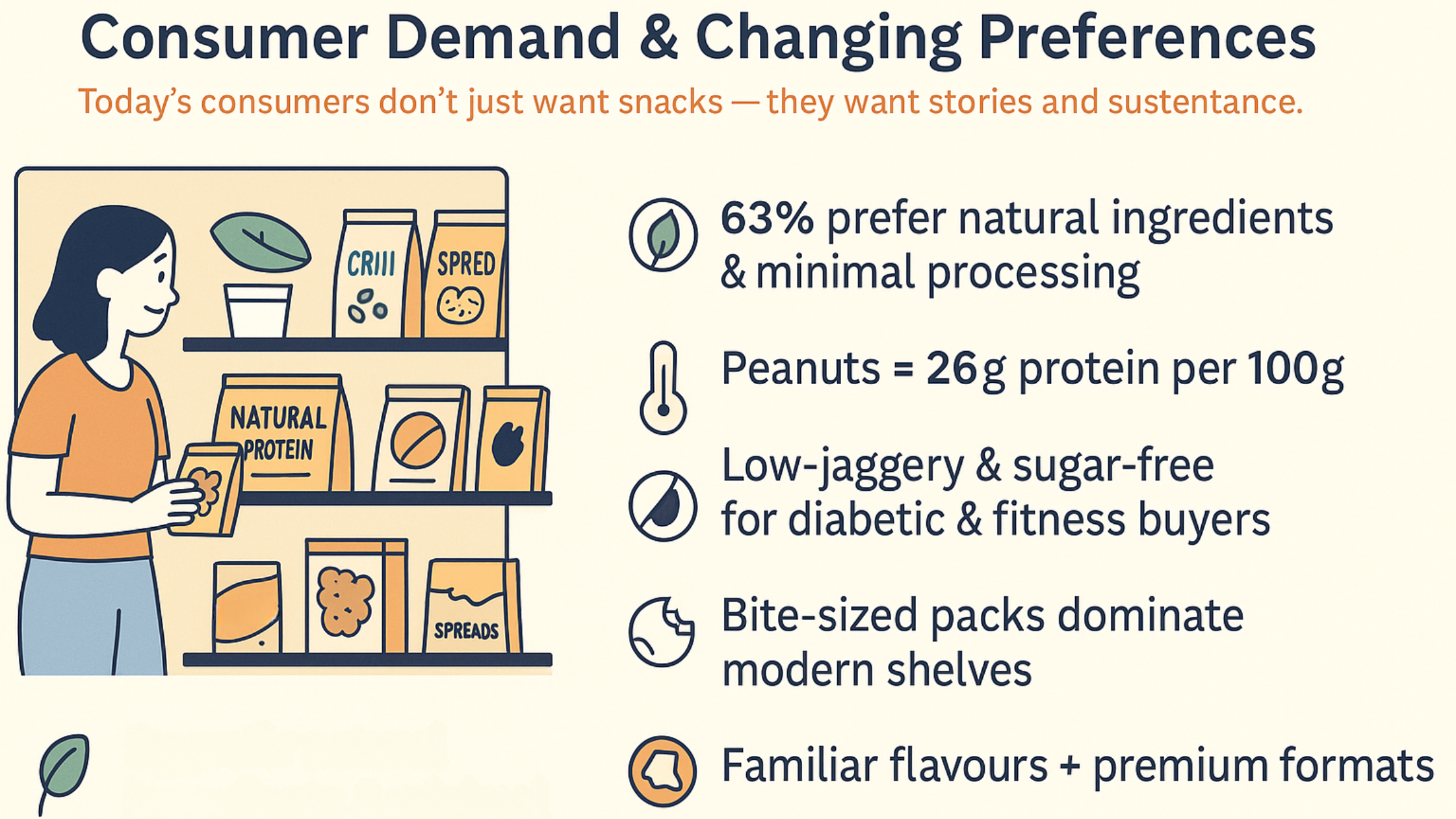

Consumer Demand & Changing Preferences

Today’s consumers don’t just want snacks; they want stories and sustenance.

Data from Mintel and Euromonitor show a rising demand for functional and nostalgic snacks – products that balance familiarity with modern relevance.

Top consumer shifts driving the peanut chikki market in India:

- Health-forward snacking: 63% of Indian consumers prefer snacks made from natural ingredients and minimal processing.

- Protein preference: Peanuts offer ~26g protein per 100g, creating scope for “natural protein bar” positioning.

- Sugar reduction: Low-jaggery and sugar-free chikkis are gaining traction among diabetic and fitness consumers.

- Portion control: Bite-sized and single-serve packs dominate modern trade shelves.

- Regional nostalgia: Urban millennials are gravitating toward familiar flavors presented in premium formats.

Insight: Consumers associate jaggery-based snacks with wholesomeness, making peanut chikki a credible entry point into the “natural indulgence” segment – where trust drives purchase intent.

Innovation – Beyond Traditional Peanut Chikki (Flavors, Formats)

Innovation is the growth engine of the new-age peanut chikki industry.

While legacy players focus on scale, emerging brands are reimagining the category through flavor fusion, fortification, and hybrid formats.

1. Flavor Innovations

- Dry fruit and seed blends (almond, sesame, pumpkin seeds)

- Regional flavors like coconut-jaggery (South India) or saffron-peanut (West India)

- Chili and sea-salt chikkis for savory appeal

2. Nutritional Fortification

- Added plant protein, flaxseed, or collagen peptides for gym-goer appeal

- Low-GI jaggery blends for diabetic consumers

- Integration of superfoods like moringa, spirulina, or quinoa

3. Format Innovations

- Chikki bars and minis: positioned as travel or school snacks

- Chikki clusters: bite-sized crunchy puffs for sharing packs

- Chikki spreads or granola variants: bridging confectionery and breakfast segments

4. Hybrid Crossovers

Chikki-inspired protein bars, chocolate-coated variants, or yogurt-dipped bites are blurring category lines, making chikki a bridge between traditional mithai and functional snacking.

The Role of Packaging & Branding in Premiumization

Packaging has become a decisive factor in turning a ₹10 local snack into a ₹100 modern retail product.

As shelf presence expands across e-commerce and supermarkets, brands that invest in clean design and functional packaging stand out.

Packaging trends driving premium perception:

- Resealable zipper pouches for family packs.

- Single-serve pillow pouches with metallic finish for impulse buys.

- Transparent windows showcasing product authenticity.

- Matte laminates and kraft-paper textures for clean-label cues.

- QR codes linking to sourcing and nutrition stories.

Branding direction:

- Emphasize heritage with innovation: traditional craftsmanship + modern fitness narrative.

- Use warm tones (browns, yellows, terracotta) that signal natural ingredients.

- Showcase origin – “Made in India,” “Sourced from Gujarat Peanuts,” etc., to build trust.

Brands that combine honesty, aesthetics, and story are redefining how peanut chikki is perceived – from roadside sweet to modern-day mindful indulgence.

Distribution Channels – Retail vs. Modern Trade vs. Online

India’s peanut chikki market is no longer limited to kirana shelves. The rise of D2C and omnichannel retail has opened new pathways for brands to scale faster, diversify SKUs, and reach niche audiences.

1. Traditional Retail

Still contributes 60–65% of total chikki sales. Dominated by small and mid-size manufacturers supplying loose or pillow-packed SKUs in regional markets. Margins are thinner, but volume and brand recall are strong.

2. Modern Trade

Modern trade chains like Reliance Smart, D-Mart, and Big Bazaar prefer packaged SKUs with strong shelf appeal and standardized barcoding.

Here, chikki competes not only with sweets but also with energy bars, granola, and protein snacks – hence, premium packaging and compliance documentation become mandatory.

3. E-commerce & D2C

Platforms like Amazon, BigBasket, and Blinkit are witnessing a steady rise in peanut chikki searches.

- Premium SKUs and combo packs perform better than ₹10 units.

- Subscription and gifting bundles are emerging opportunities.

- D2C stores allow founder-led storytelling and data-driven optimization – crucial for niche chikki startups.

4. Institutional & Corporate Gifting

Post-COVID, there’s growing adoption of healthy Indian snacks in gifting hampers and office canteens. This is an untapped segment for peanut chikki positioned as a “wholesome, guilt-free bite.”

Opportunities for New F&B Entrepreneurs

The peanut chikki market in India is currently at a tipping point – where consumer nostalgia meets innovation. For entrepreneurs, the opportunity lies in differentiation across three pillars:

1. Product Innovation

Introduce high-protein, low-sugar, or functional chikkis that fit the lifestyle snack space.

Target gym-goers, office professionals, and parents seeking healthier options for kids.

2. Brand Positioning

Move away from “sweet” and reposition chikki as a smart snack.

Taglines like “Powered by Peanuts, Sweetened by Nature” or “India’s Natural Protein Bar” create a modern perception.

3. Strategic Partnerships

Collaborate with contract manufacturers and R&D specialists like Suite42 for recipe optimization, shelf-life testing, and packaging innovation.

This lets entrepreneurs test fast, scale fast, and compete with big FMCG players on quality and efficiency.

The next decade will belong to heritage-inspired innovation – where Indian-origin products like peanut chikki earn a global stage through modern branding and manufacturing excellence.

Frequently Asked Questions (FAQs)

1. How big is the peanut chikki market in India?

The organized peanut chikki market in India is valued at over ₹700 crore, with projected annual growth of 12–15% CAGR between 2024 and 2028 (NielsenIQ).

2. Is peanut chikki considered a healthy snack?

Yes. It’s rich in natural protein, iron, and healthy fats. When made with pure jaggery and minimal processing, it serves as a clean-label, high-energy snack.

3. What types of peanut chikki products are trending in 2025?

Trends include protein-enriched chikkis, seed-and-nut blends, and low-sugar or flavored variants. Portable bar formats are especially popular in urban markets.

4. Which channels are most profitable for peanut chikki brands?

While traditional retail provides scale, modern trade and e-commerce offer higher margins and stronger brand visibility. A hybrid approach works best for emerging brands.

5. How can I start a peanut chikki brand in India?

Partner with a contract manufacturer like Suite42, finalize your recipe, validate shelf life, design premium packaging, and launch via retail + D2C simultaneously for faster growth.

6. What kind of consumers buy premium chikki products?

Urban millennials, health-conscious professionals, and parents looking for cleaner alternatives to processed snacks are the largest buyer segments for premium chikkis.

7. How does Suite42 help new brands enter the market?

An article that might interest you: Peanut Chikki Product Development in India: From Recipe Trials to Commercial Scaling

Final Takeaway

The peanut chikki industry is evolving from a cottage business into a modern, scalable FMCG segment.

By combining traditional ingredients with scientific manufacturing, food entrepreneurs can transform this timeless Indian snack into a brand with national and global appeal.

Partner with Suite42 to unlock every stage of your peanut chikki journey – from market research and formulation to manufacturing and distribution – and become part of India’s clean-label snacking revolution.

Leave a Reply